AI-Powered Credit Risk Analytics & Vintage Analysis Platform with Chatbot Interface

Enterprise-grade AI platform for portfolio monitoring and automated vintage analytics with a conversational interface.Client & Project Overview

A leading financial organization needed to modernize credit risk assessment across retail, SME, and corporate portfolios. Existing BI tools were static, slow, and required manual analysis — delaying decision-making and limiting the ability to detect emerging risks. SiriusOne built an advanced AI platform combining automated vintage analysis, risk dashboards, and a chatbot interface that answers complex credit-risk questions in natural language. The system updates daily, providing real-time visibility into portfolio health.

Business Problem

The organization faced several challenges typical for modern credit risk units:

- Manual BI dashboards that could not explain why risk changes occur

- Difficulty identifying narrow high-risk customer segments

- Lack of automated vintage analysis to detect weak origination periods

- No unified system for fraud-prone behavior patterns

- Slow decision-making due to fragmented data sources

This platform eliminated manual reporting and turned our analysts into decision-makers, not data collectors. The chatbot became a real assistant — answering complex risk questions in seconds.

Alexander Volkov

Head of Risk Analytics, Financial Institution

Tech Stack

AI Layer: GPT-based risk assistant for Q&A, Predictive segmentation models, NLP pipelines for variable interpretation

Data & Analytics: Daily ETL ingestion, Automated Vintage Engine (MOB / DPD / NPL), HeatMap segmentation, Antifraud behavioral graph analytics

Frontend: Web dashboard with custom filtering engine, Drill-down to product, region, sales channel, employee, and contract level

Infrastructure: Cloud-native deployment (AWS), Secure API gateway, Role-based access

#AIinFinTech

#CreditRisk

#VintageAnalysis

#Chatbots

Project Timeline

A structured analytics product delivery — from data discovery to enterprise rollout.

Duration

12 weeks

Effort

~2800 hours

Discovery & Research

Risk framework review, portfolio analysis, definition of NPL/DPD/MOB thresholds, identification of risk indicators.

Design & Prototyping

UX flows for dashboards, heatmap prototypes, chatbot conversational intents, data model mapping.

Development

Vintage engine, segmentation builder, antifraud module, analytics dashboards, chatbot backend, daily ETL.

Testing & Security Audit

Data validation, model explainability checks, access control tests, performance tuning.

Deployment & Training

User onboarding, automated documentation, L&D sessions, chatbot calibration.

Team involved

AI Architect

Design of conversational intelligence, predictive segmentation, and automation logic.

Data Engineer

Daily ETL flows, portfolio aggregation, risk indicator pipelines.

Risk Analyst

Validation of NPL/DPD definitions, segmentation frameworks, credit-quality logic.

ML Engineer

Vintage analysis engine, clustering, anomaly detection.

Frontend Engineer

Dashboard UI, visualization layers, filtering mechanics.

Project Manager

Governance, delivery cadence, analyst onboarding.

Solution Overview

SiriusOne delivered a next-generation risk intelligence platform that unifies portfolio analytics, vintage evaluation, antifraud detection, and conversational insights.

Portfolio Quality Dashboard

Daily-updated risk indicators (NPL, DPD 30+/90+, coverage) with drill-downs to products, regions, branches, and individual contracts.

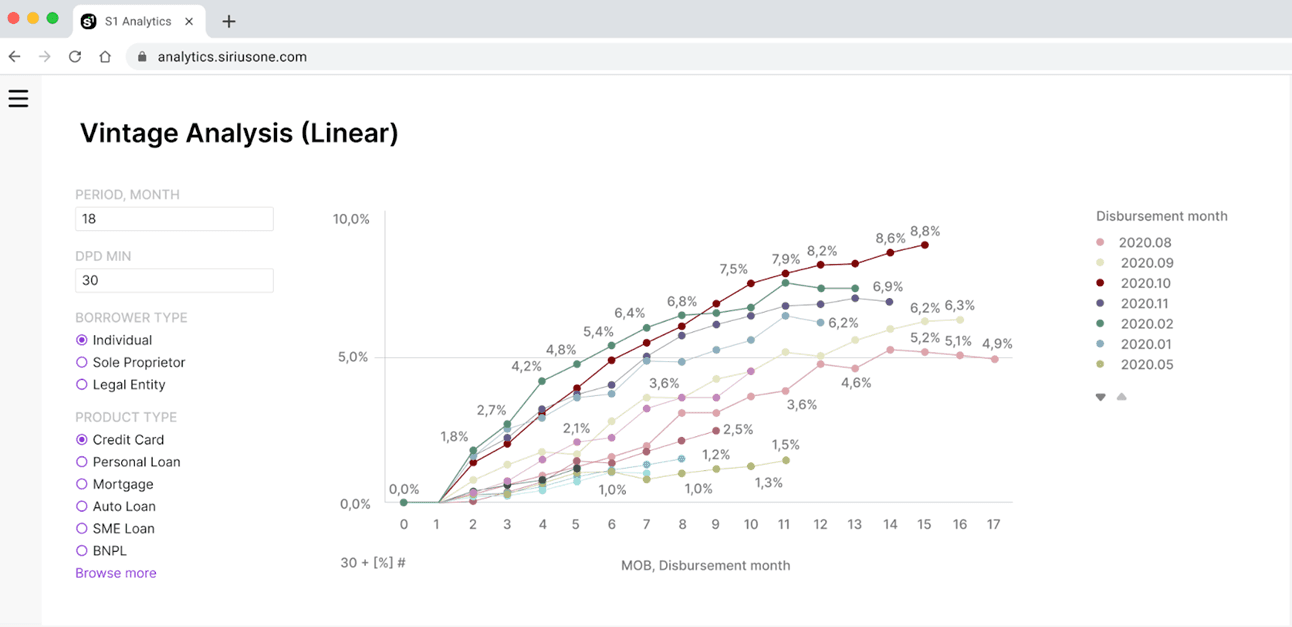

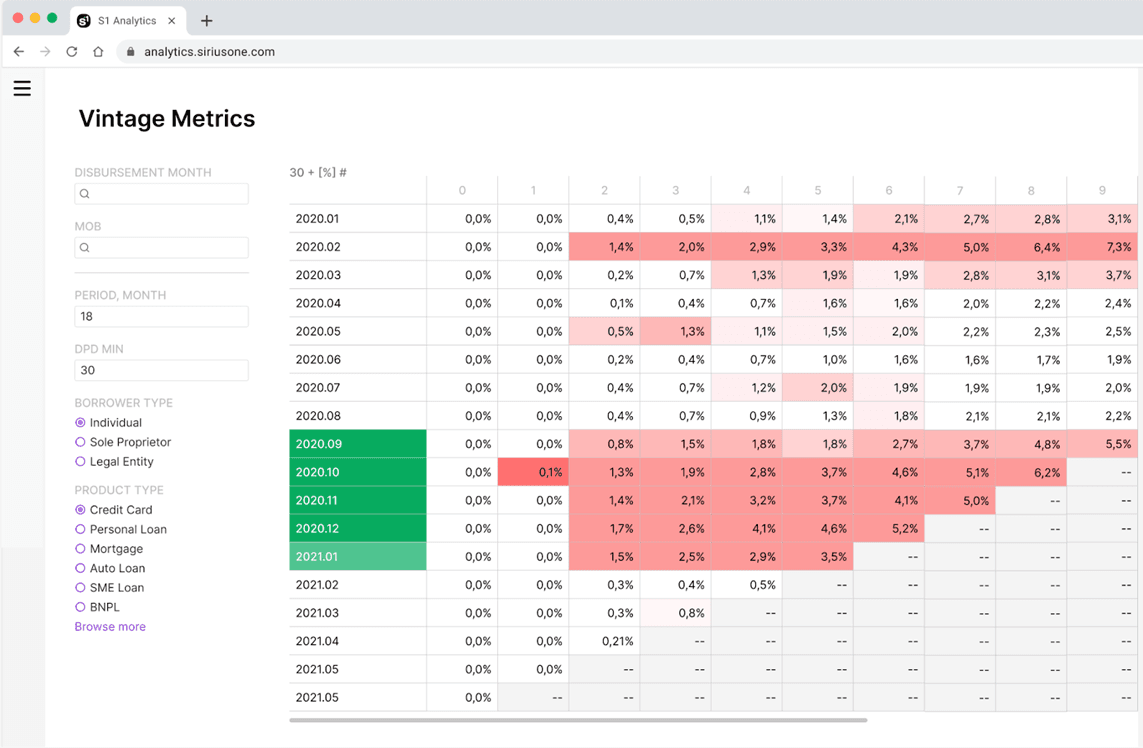

Vintage Analysis Engine

Linear curves and HeatMaps by MOB/DPD thresholds (1+ to 90+) to identify weak origination periods and deteriorating cohorts.

New Contract Quality (Pro Mode)

Flexible segmentation by demographic and behavioral attributes, comparing segments against portfolio benchmarks using triple-curve visualization.

Antifraud Behavioral Module

Graph analytics to reveal high-risk actors (agents, partners, branches) statistically linked to elevated bad-loan outcomes.

GeoAnalytics

Risk heatmaps across regions, districts, and cities used to adjust local lending terms and sales policies.

Intelligent Contract Search

Deep-dive investigations at the contract level, covering delinquency behavior, scoring attributes, and origination parameters.

AI Chatbot for Credit Risk Teams

Natural language interface (English) that generates instant charts, tables, and narrative summaries based on complex risk queries.

Results

Automated Analytics

90% reduction in manual reporting time.

Enhanced Visibility

Instant identification of deteriorating segments and weak vintages.

Better Credit Policy Decisions

Segment insights support precise risk-based pricing and eligibility rules.

Operational Efficiency

Daily updates ensure fresh portfolio data without analyst workload.

Similar

implemented cases:

AI-Powered Credit Risk Analytics Platform

AI-Powered Loan Application Automation

AI Bot for Customer Support in Retail

AI-Powered OCR Automation for Financial Document Processing

AI-Powered Image Redaction for Privacy Protection in Aerial Imagery

AI Bot for a Governmental Organization

AI Bot for HR & Recruitment Departments

Machine Learning Model for Optimal and Cost-Effective Predictions

Machine Learning-Enhanced Travel Booking Platform

AI-Powered Real Estate Valuation Platform

AI-Driven Anti-Money Laundering (AML) System